搜索结果: 1-15 共查到“经济学 tax”相关记录95条 . 查询时间(0.093 秒)

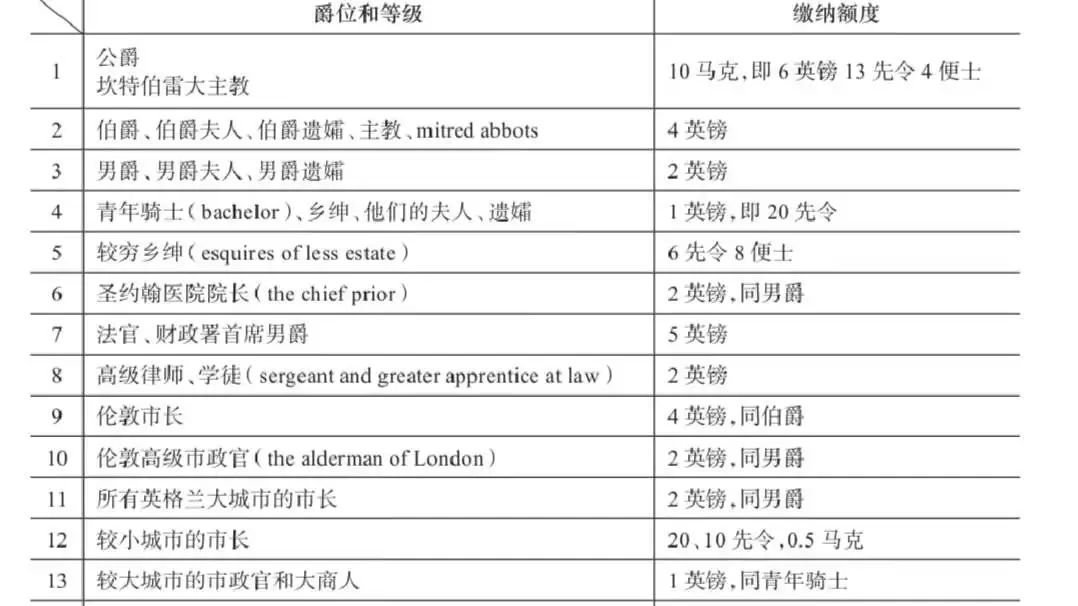

英国中古时期的poll tax是面向全国民众征收的一个具有普遍性特征的税项,国内出版物通常将之与古代中国的“人头税”对译,而忽略了两者间的差别,为避免引起误解,本文将之音译为普尔税。关于普尔税的征收,学术界大多结合瓦特•泰勒起义进行评价,基本持否定观点,但具体考察征收过程可见,其征收不仅合理、合法,而且具有一定的先进性。

Tax sharing under the Common Consolidated Corporate Tax Base:Measurement of the profit generating factors in the agriculture sector

agriculture CCCTB Corporate Income Tax formula apportionment NACE Classification

2016/9/1

The allocation formula for the distribution of the Common Consolidated Corporate Tax Base (CCCTB) should be based on three macroeconomics factors which are considered to have the largest impact on pro...

Measuring the Effective Tax Burden of Lifetime Personal Income

Lifetime tax burden Personal income Statistical simulation

2016/1/27

This paper designs and tests a comprehensive model, solved by statistical simulation, which describes and quantifies the effect of the tax system and lifelong income characteristics on the effective t...

Factors of Tax Decentralization in OECD-Europe Countries

Fiscal decentralization Local government Tax decentralization Taxation autonomy

2016/1/27

The article deals with the issue of tax decentralization to local government. The aim of the article is to describe the tax decentralization to local governments with respect to its possible determina...

Transition from US GAAP to IFRS: Analysis of Impact on Income Tax Administration in USA

Financial reporting standards IFRS IRS LIFO Tax administration TIGTA US GAAP

2016/1/27

When SEC and FASB started considering replacing US GAAP with IFRS, the impact of this change had to be considered by the various stakeholders in the financial reporting process in the U.S., including ...

Current Income Tax Disclosures in Separate Financial Statements of IFRS Adopters in Slovakia

IFRS Slovakia Taxation

2016/1/27

As a direct result of the accession into EU, IFRSs have been introduced in Slovakia as a framework for compilation of separate financial statements of various businesses since 2006. Because of traditi...

The IFRS as Tax Base: Potential Impact on a Small Open Economy

IFRS Small open economy Taxation

2016/1/27

The IFRS adoption has improved the quality of accounting information significantly. However, huge costs are incurred by all subjects involved. The process has considerable consequences for tax systems...

Legal Consequences of the Determination of Corporate Income Tax Base Referring to IFRS

Corporate income tax International Financial Reporting Standards Tax base Taxable income

2016/1/27

This paper is concerned with certain legal consequences of the determination of corporate income tax base. The introductory part analyses the term tax, discusses the constitutional dimensions of taxat...

Adjustments to Accounting Profit in Determination of the Income Tax Base: Evolution in the Czech Republic

Czech Republic IFRS Tax base

2016/1/27

The article analyzes the main trends in income, tax base and tax deductions for Czech companies in years 1993 – 2012. After an initial survey of the problem, the article describes the issue of nationa...

Tax Aspects of Mergers and Cross-Border Mergers

Cross-border mergers Take over losses Tax aspects

2016/1/27

The paper concentrates on tax aspects of merger with a special attention to cross-border ones. Despite the fact that Directive, which set the conditions for mergers, business investment and exchange r...

Behavioral Consequences of Optimal Tax Structure – Empirical Analysis

Behavioral experiments Experimental economics Hidden tax

2016/1/26

The aim of the paper was to analyze some behavioral effects, especially the effect of “hidden” tax, the “preference of progressivity” effect and some kind of “preference of short period incidence” eff...

Detection of Possible Tax-Evasive Transfer Pricing in Multinational Enterprises [full text

Multinational entities Tax authorities Tax evasion Transfer prices

2016/1/26

In this paper we analyze possible source of tax evasion in the multinational entity (hereinafter “MNE”). We show that the tax obligation of the whole MNE depends on the ownership structure of companie...

The project that is the subject of this report was approved by the Governing

Board of the National Research Council, whose members are drawn from the councils of

the National Academy of Sciences, th...

Comment on ‘Tax Policy and Investment’ by Kevin Hasset and R. Glenn Hubbard

Tax Policy Investment

2015/8/4

Comment on ‘Tax Policy and Investment’ by Kevin Hasset and R. Glenn Hubbard.

Tax incentives and the demand for life insurance: evidence from Italy

Tax incentives Portfolio choice

2015/7/23

The theoretical literature suggests that taxation can have a large impact on household

portfolio selection and allocation. In this paper we analyze the tax treatment of life

insurance, considering t...